Comme c’est souvent le cas sur le web, tout à fait par hasard, les clicks successifs vous amènent vers l’article publié par un banquier dans son blog. Son sujet paraissait intéressant, il donnait envie d’y réfléchir. Pour que nos réflexions soient compréhensibles à l’auteur du blog, avec lequel nous avons engagé un échange épistolaire, exceptionnellement, cet article est écrit en anglais.

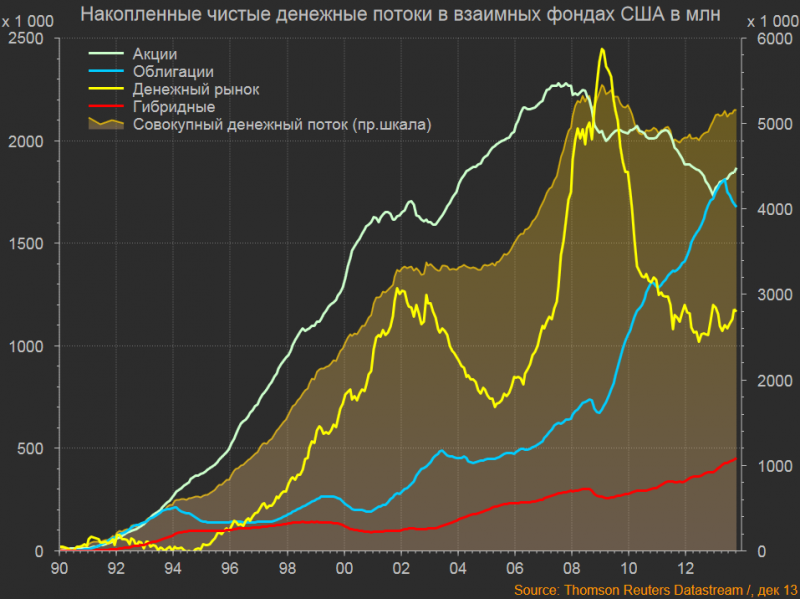

As far as we saw it, the purpose of the cited blog post is to understand, following the important outflows from financial markets, where all this money has gone. The author provides interesting numbers as for asset allocation on US financial market, more precisely within mutual funds. Since the time when the US Federal Reserve first reduced its rates as a consequence of 2008 financial crisis, monetary funds lost about $ 1.3 trillion, among which almost $1.2 trillion moved toward the bond-based funds.

On the snapshot that represents the net flows of the US mutual funds (figure on the top) one can see how the money market (a yellow line) collapsed in 2009. The author notices that it was followed by a $140 milliard outflow from the bond market (blue line) during 2013.

There is a slightly disturbing detail: as one may further notice, the blog post mentions interesting statistics, which nevertheless, are not further developed, and do not provide a sufficient insight. For example, following the reading of the phrase regarding a $140 milliard outflow from the bond market, one wonders what type of bonds we are talking about. Does this outflow concern good-quality corporate bonds? Junk bonds? Government bonds? Long-term bonds? Short term bonds? The explanation of the outflow is hidden in the underlying assets for each type of these bonds. Unfortunately the author of the blog doesn’t provide any analysis or an answer to these questions.

As far as we noticed, major corporations accumulated indecent amounts of cash during the last years. Therefore, recently they have been proceeding to the massive buy-backs of their bonds (or stocks). For instance, this is what Microsoft did in 2013, when it purchased a huge quantity of its own debt before issuing the new one, under more favourable conditions. There are huge amounts of liquidity in the market, looking for safe places to be parked at (bonds of a company like Microsoft is a safe place).

Governments also take advantage of this situation. In 2013, in anticipation of repayment of a part of its debt arriving at maturity, French government issued a new amount of debt at historically low rates, and after that it repaid the previous one. The result of the operation: positive inflow of $1.2 billion for France. Microsoft and French bonds are just two examples of a smart financial management. We are in the situation where bonds’ outflow is a positive trend.

Analysing possible directions for “bond money”, the author notices that it didn’t flow into the stock market, which saw two outflows since 2008 (almost white, slightly greenish line on the graph). The first ($250 billion), between December 2007 and March 2009 is quite understandable and is a direct consequence of the financial crisis. The second ($300 billion), between May 2011 and December 2012 seems to be less clear and contradicts the announcements of investment / mutual funds which were pushing up the markets. Their efforts to accelerate markets rally were based on the argument that, as the economy was getting better, the larger circles of investors have found new interest in the stock market.

Here we’d like to add a number of fundamental observations:

- Since a significant number of years the state of the real economy is no more related to the state of financial markets and vice versa. As any independent economic analysis shows, the real economy in developed countries hasn’t significantly improved since 2008. At the same time the US financial market is at its ever-highest level. Its growth results from significant artificial movements.

- Cash outflow from markets started years ago. The reasons are multiple. For example, the numbers of companies listed at NYSE diminished by more than 30% during the last 30 years. Among the explanations of this phenomenon we have:

- Larger concentration. Most of the largest corporations are bigger today than they were 30 years ago; therefore there are less of them.

- Direct and indirect costs. IPOs are more and more expensive (including the fact that there is more regulation), so as the regular financial reporting to the shareholders, communication with the analysts, etc. There is also a hidden price to pay: listed companies have an obligation to disclose most of the information, which may economically hinder the company and diminish its competitive advantage if, for example, certain information is disclosed too early.

- Availability of alternative sources of financing. Private equity industry hugely developed during the same period. It allows more tailored approach to the financing of corporations, and the amount of cash available for the investments doesn’t stop growing.

Therefore we may consider the different outflows that happened during the last years more like a technical movement than a trend with some real economic sense. The situation is not helped by the fact that, unfortunately, most mutual funds are rather “sheep-like”: they often follow any announcement made by the analysts without any real analysis (including in or out of a certain asset class, market, etc.). The largest “analysts-induced” manipulation of 2013 has been orchestrated around Facebook, which allowed its stock to double since the middle of the year. Nevertheless, some basic analysis allows understanding that there was nothing real behind this PR move.

The author implies that the $130 billion inflow into stocks since the beginning of 2013 looks like a “local and commanded transfers within a fierce forcing of investors into the risk”. Let’s be clear at this point: risk is no more a consideration that counts much for asset allocation. The situation of risk evaluation described in classical investment text books doesn’t exist anymore. Today’s watchword is “where do we put all this cash?” And this is exactly what creates false movements of the market, which are significant, taking into account the amounts played.

More generally, mutual funds can’t anymore be called “investment funds”. Since about 10 years they are playing a very short-term game: “we need good monthly returns for the retirement plans”. Taking into account a huge number of baby boomers who had started retiring over the last few years (and will continue to retire for at least 10 more years), this game will take them all. This is precisely one of the factors that create false movements of the market. Some rare funds that still keep “investment” logic are insurance funds: they overlook real investment prospective for the next 10-something years.

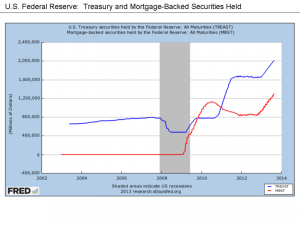

We agree with the author noticing the last-years trend of decreasing number of mutual / all types of “investment” funds, and the survival mainly of the ones close to central banks’ money. We dare to say that this trend is clearly due to the strong political will. The explanation is quite simple: If the market counted fewer players, the financial crisis of 2008 would have been resolved within an insignificant period of time. The famous Troubled Assets Relief Program that has been pushed to the world during the night of  October the 3d, 2008 would have worked. TARP has directed $700 billion to the purchase directly for cash of mortgage-backed securities from large financial organizations. The logic was: we amputate these toxic products from main market players and the gangrene will stop. This is a bullet-proof tactic when you have a perfect knowledge of the number and the quality of the market players. What US Treasury and all other governing organisations have completely overlooked is the real number of funds of all sizes and types having these toxic assets. Everybody had them, and everybody was trying to throw them away to the others. We have seen the roll-out of the story during the last 5 years.

October the 3d, 2008 would have worked. TARP has directed $700 billion to the purchase directly for cash of mortgage-backed securities from large financial organizations. The logic was: we amputate these toxic products from main market players and the gangrene will stop. This is a bullet-proof tactic when you have a perfect knowledge of the number and the quality of the market players. What US Treasury and all other governing organisations have completely overlooked is the real number of funds of all sizes and types having these toxic assets. Everybody had them, and everybody was trying to throw them away to the others. We have seen the roll-out of the story during the last 5 years.

There is something deeply intelligent that the Americans did in all this mess (and that the Europeans still don’t dare to do): even before the adoption of Volker rule they started to separate banks and other investment structures. There was some scaling, some forcing, but there was a good cleaning up done within American financial system, as the opposite to the rest of the world. And yes, some small funds had to disappear, all this in addition to the fact that corporations appeal less and less to the markets for their funding.

Images from Spydell blog , Wikipedia and ICI